Like all economic actors, SCPI (French Public Real Estate Vehicle) have experienced an unprecedented situation this year by the great complexity of the issues they had to face. While the year 2020 had started very energetically following the best way possible to be a record year, the dynamic has been suddenly stopped by the Covid-19 crisis and the first confinement.

This unexpected situation nevertheless allowed SCPIs to face a large-scale “stress test”, testing their ability to adapt and resist in an unprecedented context marked by a complete or partial shutdown for most economic activities. Despite the constraints caused by the pandemic, asset management companies have been able to react in order to support struggling tenants, implementing relief measures (rent installments, rent-free periods or partial cancellation rents). The proximity of SCPIs to their occupants, the proactive attitude of asset management teams and the transparency with final investors deserve to be acknowledged.

The annual raising remains dynamic in spite of difficult economic conditions

The net capital raised by SCPIs for the year 2020 amounts to 6.01 bn €. Obviously, it represents a decline of 30% as compared with 2019, even if it is still the third best result in 50 years of their history. Yet, it seems important to keep in mind the gloomy economic situation due to the coronavirus crisis.

Nevertheless, it should be noticed that real estate investment funds have managed to resist by maintaining a high level of inflows. The 2020 has finally benefited from a very good first quarter but also from a significant rebound during the last quarter.

In this situation, Office and Retail SCPIs are obviously those which have been the most weakened, with the rise of work from home and closure of shops imposed by governments. Less affected, Diversified SCPIs have been able to rely on their greater variety of asset classes constituting their portfolios, providing them a better risk allocation. Finally, Specialized SCPIs show very large disparities. Indeed, Hotel SCPIs were probably the SCPI sub-category most affected by the global pandemic due to the closure imposed. On the contrary, SCPIs focused on the logistics industry and healthcare have been among the most dynamic on the market, above all because activities carried out in these asset classes have continued to operate (even more than before).

Comparison between banking and independent network of SCPI’s management companies

Independent and bank-affiliated management companies have suffered from a health crisis with loss of funds raising pace, especially in the second quarter during the first lockdown. The former saw their fundraising rate rebound from the third quarter while we should expect the fourth quarter for the latter.

Market capitalisation breakdown

The new breakdown of capitalization resulting from the evolution funds raised over 2020 logically shows the following trend: Office and Retail SCPIs see their market shares decrease in favor of Diversified and Specialized SCPIs.

An increasing number of shareholders with for smaller investment tickets

Even if the number of shareholders has increased, the average capital has decreased with the arrival of new savers who tend to invest less and diversify largely their portfolios (average ticket of 74,825 € per shareholder per SCPI).

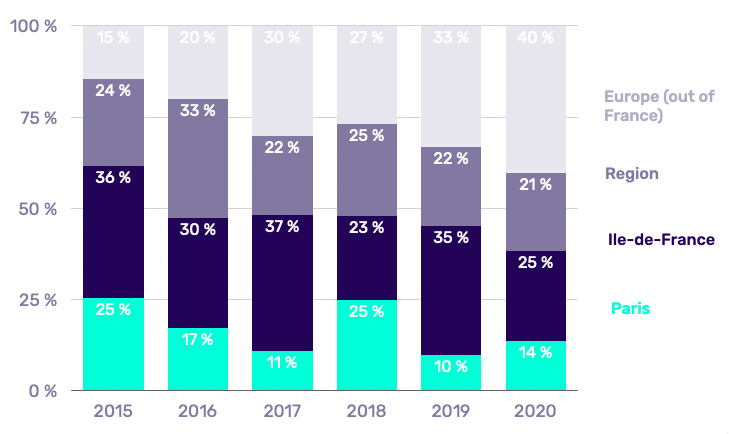

International investments capturing more and more interest

It should be emphasized that during the Covid-19 pandemic, SCPIs have continued to make new investments, particularly out of France, which represents 40% of investments realized in 2020. Overall, SCPIs invested € 7.34 bn over 2020 (compared with € 9.51 bn in 2019), adapting investment pipeline to a new fundraising pace.

A dividend distribution greater than 4 %

While SCPIs have been very careful distributing dividends in the beginning of the year, by adapting them to rent collection pace, they managed to largely exceed the threshold of 4% for annual distribution. Thus, the large number of rent-free periods and deferrals of rents granted to tenants, in particular for retail-invested SCPIs, did not significantly affect the distribution of dividends. With an average performance of 4.20% in 2020, SCPIs remained at a very high performance level for the period, confirming thus the very resilient nature of this investment.

A revaluation of the average share price beyond 1%

The average share price adjustment has increased by 1.08%, which is mainly explained by the readjustments realized in the beginning of the year (for information SCPI have to offer its shares for new subscription at a price included in +/- 10% vs NAV value per share). The uncertainty about post-covid market value of certain assets have significantly stopped the price adjustments. It is important to note that no variable capital SCPI has decreased its share price over the last year.

Stability of withdrawals

The great confidence of SCPIs’ shareholders is reflected through cash volume withdrawal since they remain very low. In fact, the drop in fundraising results above all from a decrease in subscriptions and not from a wave of massive withdrawals. Subscriptions for new units thus remained much higher than requests for withdrawals, proof of current shareholders trust, who well understood the stake to have a long-term vision for their investment.

A slightly lower financial occupancy rate

The average financial occupancy rate of SCPIs has fallen slightly since the second half of the year. However, it remains at a very good level at 89.25%, above 90 % for all categories except for offices. The real impact of the health crisis will be more noticeable next year given the time needed to end some of the leases.

Interesting funds classes to identify

Even if the distribution of SCPIs by major classes (offices, shops, diversified and specialized) provides a fair view of the SCPIs market, it may be interesting to look at the main themes in which SCPIs are invested in order to have a better understanding of the market.

Specialized SCPIs, for example, show very disparate results between healthcare SCPIs (4.64%), logistics SCPIs (4.93%) and SCPIs focused on the hotel industry (2.13%).

With the sharp increase in investments abroad in recent years, pan-European SCPIs are on the rise. By seizing the opportunities offered by the various European markets and reducing risk through geographic pooling, pan-European SCPIs outperform the market (4.55%). Finally, the eligibility of real estate funds for the SRI label since the end of October 2020 has already enabled 6 SCPI to obtain the precious sesame. These SCPIs have greatly performed with 4.74% average return.

2021 Perspectives

If in 2020, the effect of the health crisis could be offset, the year 2021 will be decisive because it will provide a better visibility of the crisis consequences.

The cash flow of businesses has fallen, weakening their ability to pay their rents. In office properties, the use of teleworking has changed habits, impelling companies to downsize their offices and make economies. In addition, too many business closures could generate an oversupply of unoccupied premises and lead to rent level decrease.

Nevertheless, at the end, the share prices were barely impacted in 2020, this could change in 2021, creating opportunities to invest at a very discounted share price for fixed capital vehicles.

All

All